Bitcoin Correction Amid Federal Reserve Expectations

Contents:

- Bitcoin in a Bind Over Federal Reserve Outlook

- Inflation Trend Data and Its Impact on Bitcoin

Bitcoin succumbed to negative sentiment over the weekend ahead of the Federal Reserve’s upcoming meeting.

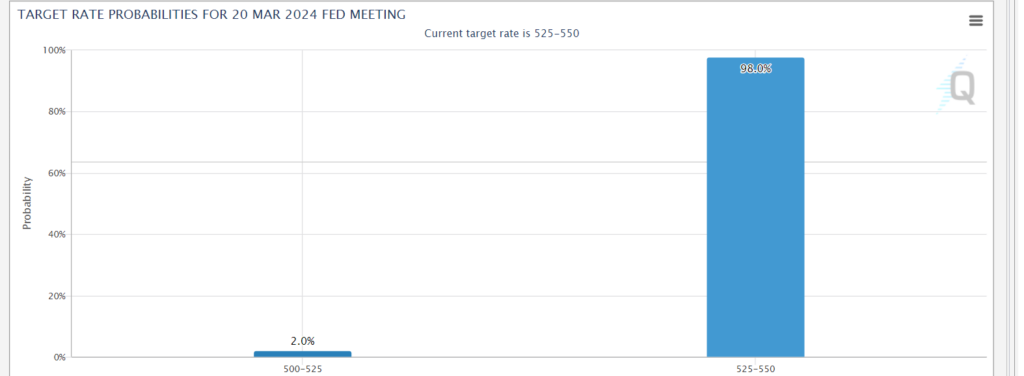

The Federal Open Market Committee will convene on March 19-20 to announce the targeted federal funds rate on March 20 at 2 p.m. Recent statements from Federal Reserve officials suggest that interest rates are unlikely to rise from their current levels, with cuts potentially imminent but not certain.

Bitcoin’s market witnessed a period of correction, signaling a potential shift in the cryptocurrency’s value. This correction phase gains momentum, prompting investors and analysts to closely monitor market behavior and identify potential contributing factors.

Furthermore, looming expectations for Federal Reserve interest rates add another layer of complexity to the situation, as they have the potential to impact the cryptocurrency market and the broader financial landscape.

Bitcoin in a Bind Over Federal Reserve Outlook:

As the weekend approaches, Bitcoin fell victim to negative sentiment. Today, the value of Bitcoin (BTC) stands at $67,038.34, representing a 1.5% decrease since yesterday and a 0.4% decrease from the past hour. Compared to seven days ago, Bitcoin’s value has decreased by 4.1%. Bitcoin’s Fear and Greed Index is also at 79, indicating extreme greed.

The current market capitalization of cryptocurrencies is $2.64 trillion, representing a 117.81% increase on a yearly basis and a -2.99% change over the past twenty-four hours. Currently, BTC holds a market capitalization of $1.31 trillion, indicating a market share of 49.39%. Stablecoins, at $149 billion, represent 5.63% of the total cryptocurrency market capitalization.

Interest rates are expected to remain unchanged at the March Federal Reserve meeting. However, price declines are expected in 2024, and the market will seek hints about the timing of these declines.

The Federal Open Market Committee will meet from March 19 to 20 and announce the targeted federal funds rate on March 20 at 2 p.m. ET. The current target range is 5.25% to 5.5%, with no expected changes.

Subsequently, at 2:30 p.m. ET, Federal Reserve Chair Jerome Powell will hold a press conference to provide additional key information and answer questions. Additionally, officials will update the Summary of Economic Projections, including a set of estimates, sometimes referred to as dot plots, estimating the placement of interest rates by the end of 2024. On April 10, the Federal Reserve is expected to release the March meeting minutes.

All of this will be closely monitored by fixed-income markets. According to the CME FedWatch tool, interest rate cuts are currently expected to begin in June or July, with three or four cuts expected in 2024.

Michelle Bowman, a member of the Federal Reserve Board of Governors, recently expressed more hawkish views. Bowman said in a speech on March 7: “If incoming data continue to signal that inflation is moving sustainably toward our 2 percent goal, it will eventually become appropriate to gradually lower the federal funds rate to prevent monetary policy from becoming overly restrictive.”

She added, “In my view, we have not yet reached that stage. Lowering the federal funds rate too early could necessitate further increases in the future to bring inflation back to 2 percent over the long run.”

Inflation Trend Data and Its Impact on Bitcoin:

Inflation has declined from its peak but remains below the Federal Reserve’s annual target of 2%. The latest Consumer Price Index report for February indicated an annual inflation rate of 3.2%. The Federal Reserve often prefers the Personal Consumption Expenditures Price Index, which reported an annual inflation rate of 2.4% in January.

The Personal Consumption Expenditures Price Index for February will be adjusted on March 29 after the Federal Reserve meeting on March 20. One source of concern is that despite significant inflation slowing since its peak, current data suggests that inflation may accelerate slightly by early 2024.

For example, inflation in the Consumer Price Index rose by 0.3% monthly in January and 0.4% in February. Both levels are higher than they were in the past twelve months. To achieve its 2% target, the Federal Reserve will need to see monthly inflation ranging from 0.1% to 0.2% approximately. However, inflation has declined significantly from its peak in 2022.

Read more Robert Kiyosaki Predicts Bitcoin to Reach $300,000 by Year-End

The Federal Reserve monitors statistics and hopes to have confidence that inflation will return to its 2% target before committing to interest rate cuts. Current concerns about short-term inflation may be alleviated. According to the Federal Reserve Bank of Atlanta’s Consumer Price Index expectations tool for March, inflation is expected to be closer to 0.2%.

Based on data available on the chain, net inflows into the immediate Bitcoin exchange-traded fund market decreased on Friday. Bitcoin is being sent to the south. On Saturday, March 16, Bitcoin fell by 5.99% to close at $65,437.

The flow data of the exchange-traded fund market in the BTC-spot from Friday (March 15) influenced buyer demand for Bitcoin.

On Friday, net inflows into the BTC-spot exchange-traded fund market amounted to $338.2 million (excluding outflows from the Grayscale Bitcoin Trust (GBTC)). Net inflows (excluding GBTC withdrawals) decreased from $389.8 million on Thursday (March 14) to $960.2 million on Wednesday (March 13).

Important Notice: Disclaimer Regarding Financial Advice

The information presented in this article is intended solely for informational purposes and should not be considered as financial advice. Coinshiba.online disclaims any responsibility for investment decisions made by individuals relying on the information provided herein. It is highly recommended to consult with a qualified professional or financial advisor before making any investment decisions. Your financial well-being is crucial, and seeking expert guidance ensures that your investment choices align with your individual financial goals and risk tolerance.