Bitcoin Faces Key Resistance at $50,000: Perspectives and Potential Outcomes”

In a noteworthy breakthrough, Bitcoin has surpassed the $50,000 mark, with bullish trends sweeping through the entire cryptocurrency market. Notably, Peter Schiff, a prominent Bitcoin critic, has characterized recent price movements as a “rally.” Schiff’s critique comes at a time when Bitcoin’s volatility takes center stage in trader concerns.

Despite unprecedented growth in digital assets over the past decade, significant price fluctuations have given credence to market manipulation claims. Critics challenge Schiff’s viewpoint, arguing that Bitcoin’s long-term upward trajectory paints a different picture, positioning Bitcoin as a lucrative yet high-risk investment compared to traditional assets like gold.

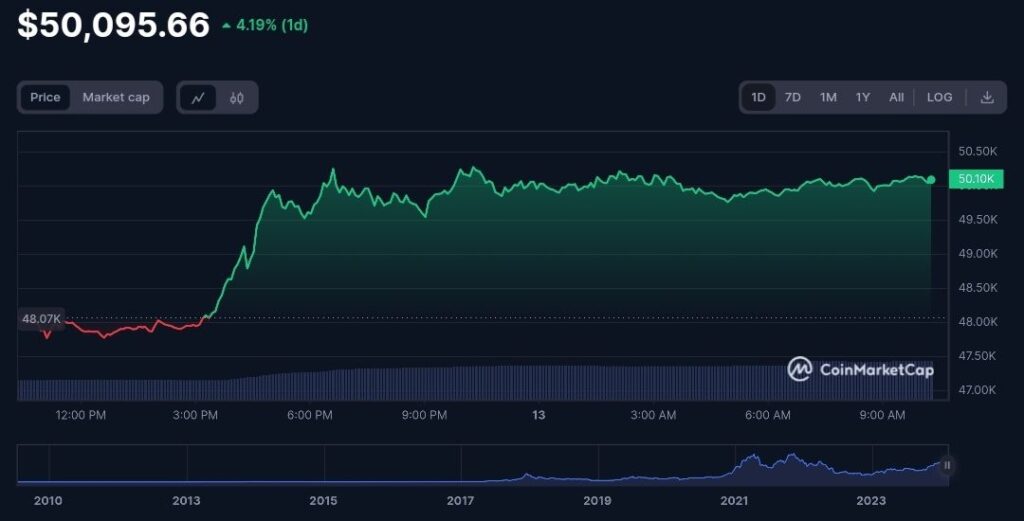

Current Path of Bitcoin: Recently breaking the resistance level at $48,000, Bitcoin’s upward expectations have been bolstered, with the next significant resistance around the $52,000 range. If the price maintains momentum and overcomes this hurdle, an extension of the current upward movement is plausible.

Possibility of a Pullback: In the event of a pullback, the support level near $44,000 becomes crucial. A resilient defense of this level may signal market consolidation before another upward move. Conversely, slipping below this support could affirm Schiff’s assertions, triggering widespread selling.

While Schiff continues to advise investors to stick with gold, considering it a stable store of value, Bitcoin has emerged as a new-age investment outperforming gold significantly, especially in the context of recent inflationary trends. However, Bitcoin’s journey has been marked by higher risks and volatility, contrasting with the stability of gold, albeit with less drama.

As the market digests recent ETF listings and the buzz surrounding them, Bitcoin’s true test lies in its performance post the $50,000 breakout. Will it sustain its growth, or will Schiff’s anticipated “slaughter” materialize? Only time will reveal the answer.

Important Notice: Disclaimer Regarding Financial Advice

The information presented in this article is intended solely for informational purposes and should not be considered as financial advice. Coinshiba.online disclaims any responsibility for investment decisions made by individuals relying on the information provided herein. It is highly recommended to consult with a qualified professional or financial advisor before making any investment decisions. Your financial well-being is crucial, and seeking expert guidance ensures that your investment choices align with your individual financial goals and risk tolerance.